Here is the Modified Basis of Allotment for

IPO Applications being submitted under the

Retail Individual CategoryTotal number of equity shares offered in the issue: 10 million, at an issue price of Rs. 600 per equity share. The retail portion for the issue consists of 3.5 million equity shares. The issuer fixes the minimum bid lot as 20 equity shares.

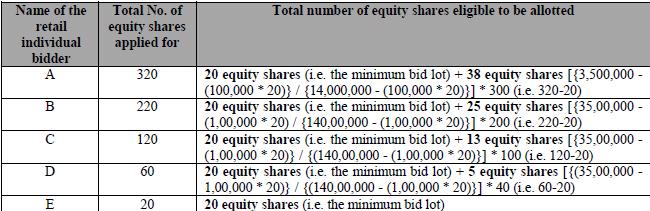

AA total of 0.1 million retail individual bidders have applied in the issue, in varying number of bid lots i.e. between 1 to 16 bid lots, based on the maximum application size of up to Rs. 200,000. The retail individual bidders’ category is oversubscribed 4 times. From the 0.1 million retail individual bidders, there are five retail individual bidders, namely A, B, C, D and E, who have applied in the issue as follows: A has applied for 320 equity shares, B has applied for 220 equity shares, C has applied for 120 equity shares, D has applied for 60 equity shares and E has applied for 20 equity shares. As per the SEBI Regulations, the allotment to retail individual bidders shall not be less than the minimum bid lot, subject to availability of shares, and the remaining available shares, if any, shall be allotted on a proportionate basis. Accordingly, the actual entitlement of each of A, B, C, D and E shall be as follows:

B

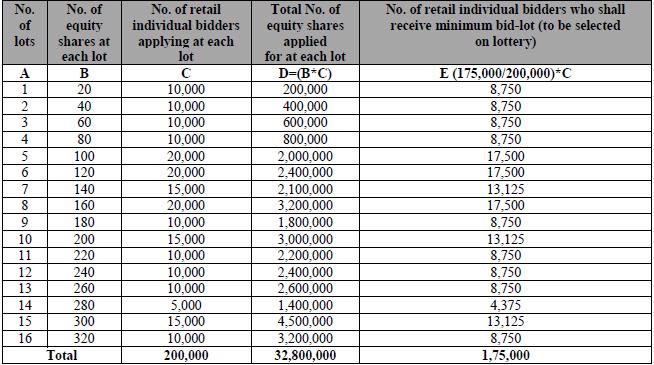

BA total of 0.2 million retail individual bidders have applied in the issue, in varying number of bid lots i.e. between 1 to 16 bid lots, based on the maximum application size of upto Rs. 200,000. The retail individual bidders’ category is oversubscribed 9.37 times. Since the total number of equity shares offered retail individual bidders is 3,500,000 and the minimum bid lot is 20 equity shares, the maximum number of retail individual bidders who can be allotted this minimum bid lot will be 175,000 (i.e. 3,500,000/20). The remaining 25,000 retail applicants will not get allotment and such bidders will be determined on basis of draw of lots, in the manner provided below:

So How to Apply to maximize the Chances of Allotment with Least Money ?

So How to Apply to maximize the Chances of Allotment with Least Money ?For Smaller IPOs which will have Heavy Oversubscription, Apply at the Rs 15,000 to Rs 20,000 Bracket so that you don't BLOCK money and yet get allotment.

For Larger IPOs, Apply for full Rs 200,000 as the number of shares that get allotted will be Minimum Lot + <Something>