For FY2015, SRL posted 14% revenue growth largely driven by store additions as SSSG remained negative due to sustained pressure on demand. We note the company added 14 stores during the year (including four confectionery stores) and closed down nine stores equating to a net addition of just five stores during the year.

Weekday demand remains under pressure due to lower corporate demand. Negotiations with vendors in February didn’t yield expected benefits due to the impact of unseasonal rains on visibility of input price movement; the management cautioned that normal monsoons remain critical to sustain GMs at current levels. Effective service tax will increase from 4.9% to 5.6% from June 2015 and is unlikely to

have any major impact on demand.

SRL recently added two franchises (one Mainland China and one Sigree) in Tanzania and is planning to start operations in Doha soon (JV model).

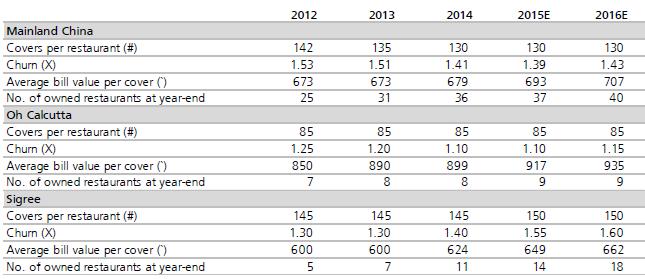

Speciality Restaurant Footfalls and Billing Sales Per Customer