Tata Chemicals Ltd [TCL] business model has too many moving parts with a presence across diverse but not so glamorous sectors such as soda ash, branded edible salt and fertilisers. TCL is the third-largest producer of soda ash in the world today and India’s leading fertiliser producer and distributor, as well as having a strong management pedigree.

Tata Chemicals Ltd [TCL] business model has too many moving parts with a presence across diverse but not so glamorous sectors such as soda ash, branded edible salt and fertilisers. TCL is the third-largest producer of soda ash in the world today and India’s leading fertiliser producer and distributor, as well as having a strong management pedigree.

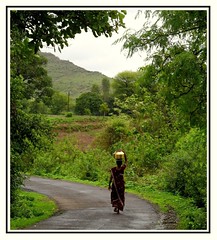

The next leg of India’s growth story will have to involve raising agricultural productivity and TCL is a play on this structural trend. TCL is not only one of the most energy-efficient urea manufacturers in India, but also has strong brands in phosphatic and complex fertilisers. TCL is not only one of the most energy-efficient urea manufacturers in India, but also has strong brands in phosphatic and complex fertilisers. Even more interesting are TCL’s plans to reach out to over 2.5m farmers through its distribution network of Tata Kisan Sansars, a one-stop shop for farmers.

TCL’s investments in Tata Group companies is valued at Rs47bn, well above the carrying value of Rs7.7bn on TCL’s books. The group holding itself translates to Rs 200 / share.

TCL currently trades at FY09F P/E of 10.4x and P/B of 1.8x, a near 50% discount to the BSE Sensex, despite having a comparable FY09F ROE of 17.7% and FY07-09F EPS CAGR of 19% on our estimates. TCL’s valuations look well-supported by its FY09F equity free cash flow yield of 6.7% and dividend yield of 3.8%. ABN Amro values TCL’s core business at Rs90bn using a three-stage DCF model and add the value of its investment portfolio at a 30% holding company discount to get a target price of Rs450 per share, implying upside of 47% from current levels.